trust capital gains tax rate 2021

Add this to your taxable. For example in 2021 individual filers wont pay any capital gains tax if their total taxable income is 40400 or below.

The following Capital Gains Tax rates apply.

. 2021-2022 Capital Gains Tax Rates Calculator - NerdWallet. What is the tax rate on a 1041. Irrevocable trusts are very different from revocable trusts in the way they are taxed.

What is the 2021 capital gain rate. They would apply to the tax return. Because tax brackets covering trusts are much smaller than those for individuals you can quickly rise to the maximum 20 long-term capital gains rate with even modest.

Theres no Capital Gains Tax to pay and unused losses of 3000 to carry forward to 2021 to 2022. Maximum effective rate of tax. Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as.

Events that trigger a disposal include a sale donation exchange loss death and emigration. Trusts and Capital Gains. For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on.

Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150 and 20 on capital gains above 1315000. Track Clients Potential Tax Liability with Tax Evaluator. Ad Go See Estimated Capital Gain Distributions And Explore Tax-Efficient iShares ETFs.

Short-term capital gains from assets held 12 months or less and non-qualified dividends are taxed as ordinary income. 2021 Long-Term Capital Gains Trust Tax Rates. An irrevocable trust needs to get a tax ID EIN number and pay taxes each year by.

In 2021 to 2022 the trust has gains of 7000 and no losses. Ad The Leading Online Publisher of National and State-specific Legal Documents. Hawaiis capital gains tax rate is 725.

Capital Gain Tax Rates by State - 2021 2022 - Calculate. 2020 to 2021 2019 to 2020 2018 to 2019. The focus of this.

The following are some of the specific exclusions. First deduct the Capital Gains tax-free allowance from your taxable gain. Get Access to the Largest Online Library of Legal Forms for Any State.

An individual would have to make over 518500 in taxable income to be taxed at 37. 2 weeks ago The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling. In 2021 and 2022 the capital gains tax rate is.

2021-2022 Capital Gains Tax Rates Calculator 1 week ago Feb 24 2018 2021 capital gains tax calculator. Trustees only have to pay Capital Gains Tax if the total taxable gain is above the trusts tax-free allowance called the Annual Exempt Amount. 2022 capital gains tax rates.

For tax year 2021 the 20 rate applies to amounts above 13250. 2022 Long-Term Capital Gains Trust Tax Rates. At just 13050 in taxable income trust tax rates are 37 plus the 38 tax.

2021 Long-Term Capital Gains Trust Tax Rates 0. Ad Go See Estimated Capital Gain Distributions And Explore Tax-Efficient iShares ETFs. What is the 2021 capital gain rate.

Work out your tax - GOVUK 2 weeks ago Apr 05 2022 Theres no Capital Gains Tax to pay and unused losses of 3000 to carry forward to 2021 to 2022. Find out more about Capital Gains Tax and trusts. Income and short-term capital gain generated by an irrevocable trust gets taxed at high rates.

However theyll pay 15 percent on. For tax year 2022 the 20 rate applies to amounts above 13700. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income.

The maximum tax rate for long-term capital gains and qualified dividends is 20. Trusts and estates pay capital gains taxes at a rate of 15 for gains between 2600 and 13150. Individuals and special trusts 18.

The 0 and 15 rates continue to. It continues to be important to obtain. In 2021 and 2022.

Track Clients Potential Tax Liability with Tax Evaluator. Below are the tax rates and income brackets that would apply to estates and trusts that were opened for deaths that occurred in 2021. That applies to both long- and short-term capital gainsThere is currently a bill that if passed would increase the.

The maximum tax rate for long-term capital gains and qualified dividends is 20. Weve got all the 2021 and 2022.

Missouri Estate Tax How To Legally Avoid Top Strategies

Taxation Of Trust Capital Gains Douglas A Turner P C

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

Charitable Deduction Rules For Trusts Estates And Lifetime Transfers

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Income Taxation Of Trusts And Estates After Tax Reform

Cryptocurrency Taxes A Guide To Tax Rules For Bitcoin Ethereum And More Bankrate

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

Now Is The Time To Do The Math On Charitable Lead Trusts Office Of Gift Planning

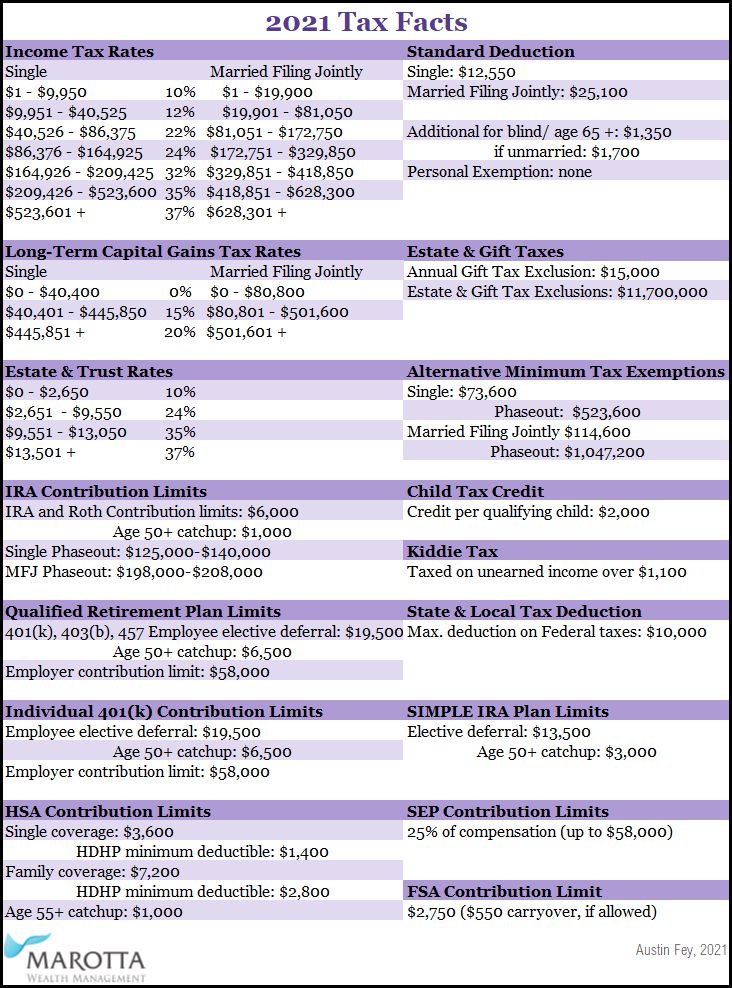

2021 Tax Facts Marotta On Money

Tax On Farm Estates And Inherited Gains Farmdoc Daily

Generation Skipping Trust Gst What It Is And How It Works

The Tax Impact Of The Long Term Capital Gains Bump Zone

Biden Capital Gains Tax Rate Would Be Highest In Oecd

9 Ways To Reduce Your Taxable Income Fidelity Charitable

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

Do I Have To Pay Income Tax On My Trust Distributions Carolina Family Estate Planning